Managing family finances can often seem overwhelming, but it becomes much more manageable with the right tools. Enter budget printables—easy-to-use, customizable sheets that help you keep track of your income and expenses without the hassle of complex software.

Whether you aim to cut unnecessary spending, save for a big purchase, or gain a clearer picture of your financial health, these 23 budget printables can provide the structure you need.

Featuring expense trackers, savings goals, monthly budget templates, and more, each printable serves a unique purpose and can be tailored to fit your family's specific needs.

With these practical resources at your fingertips, budgeting becomes less of a chore and more of a systematic process toward achieving financial well-being.

When families commit to the budgeting habit, they reap the following benefits:

Ideally, a budget should be written down. This can be done on actual paper, a spreadsheet, or a budgeting app.

In this article, you’ll find a collection of free budget printables that you can use to track your family’s expenses.

Read on and check out the fabulous budgeting printable designs we’ve rounded up for this collection.

Step-by-Step Guide to Using Budget Printables

There are many different general ideas of things you may want to track for your family budget. Creating and sticking to a family budget can be simplified using budget printables. Here's a step-by-step guide to help you utilize them effectively:

- Budget Overview: Start by clearly showing your current financial situation. Gather all relevant financial documents and input what you earn and spend each month into a budget worksheet.

- Monthly Budget Tracker: This tool records your monthly income and expenses. Categorize each entry under-budgeted categories such as groceries, utilities, entertainment, and savings. This will help you monitor your spending habits.

- Budget Planner: Use a budget planner to plan your finances at the beginning of each month. This involves setting limits for each budgeted category to ensure that your spending aligns with your financial goals.

- Budget at a Glance: Generate a snapshot of your overall budget to monitor your progress quickly. This simplified overview lets you see where most of your money goes and adjust as necessary.

- Cash Envelope System: For categories where overspending is a risk, consider using the cash envelope system. Allocate cash into envelopes for each spending category, which aids in sticking to your spending plan.

- Debt Tracker: Use a dedicated debt tracker to keep track of debts. Record balances, interest rates, and minimum payments to help prioritize and manage repayments.

- Cash Reserve: Set aside funds in a cash reserve for emergencies. This reserve is a buffer to cover unexpected expenses without disrupting your budget plans.

- Longer-Term Expenses: Plan for future expenses by categorizing and setting aside savings for family vacations, new appliances, or education fees. Incrementally contribute to these longer-term expenses each month.

- Separate Savings Account: Open a separate savings account for better financial management. It allows you to allocate funds for specific goals and prevents unnecessary withdrawals.

By diligently following these steps, you can effectively use budget printables to manage your family expenses, enabling financial stability and peace of mind.

to manage your family expenses, enabling financial stability and peace of mind.

1. Monthly Budget Planner Tracker

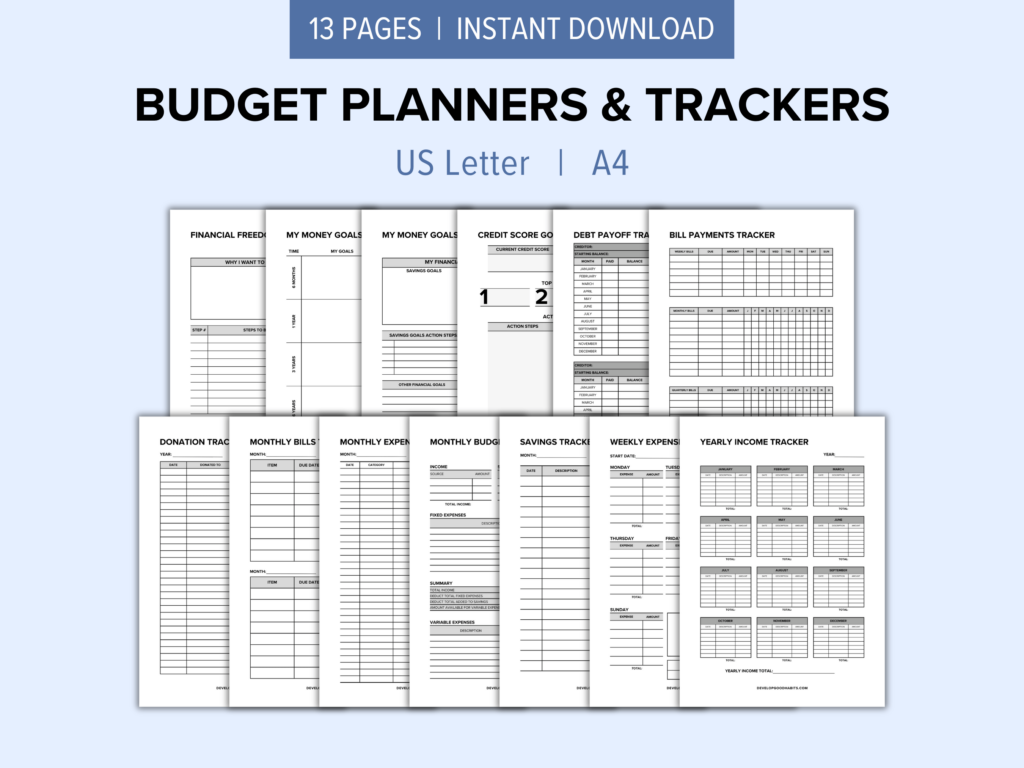

Check out Monthly Budget Planner Tracker on Etsy

Reach your financial goals with this Budget Planner bundle.

Featuring templates for tracking your credit score, health, income and expenses, debt repayment, and budget, each fillable and printable planner is designed to help you monitor everything related to your hard-earned money.

Achieve financial freedom in no time with this planner bundle.

2. Monthly Budget Planner Tracker

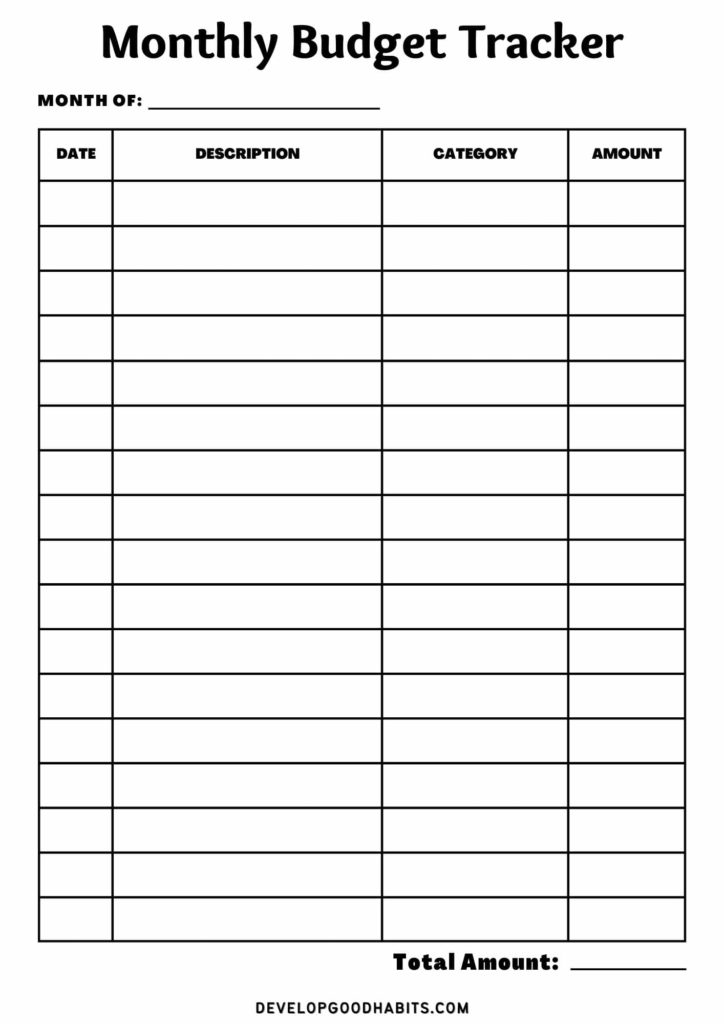

If you’re new to budget tracking, you might want to use this reasonably straightforward tracker we’ve created. It provides all the information you need about your monthly expenditures at a glance.

This tracker has spaces allocated for recording expenses throughout the month, with a description of each expense, the amount, and the date.

You can indicate the type of expense in the “category” column. At the bottom of the page is a section for writing down the total costs incurred for the month.

3. Monthly Budget Planner

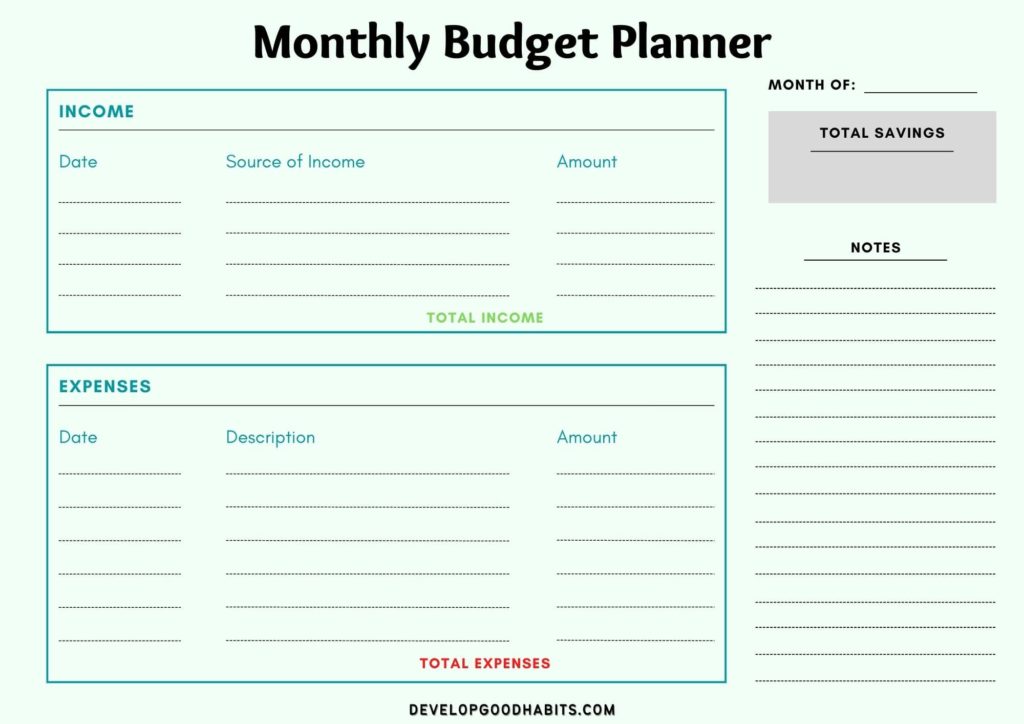

Do you often wonder why you’re overshooting your monthly budget? Our budget planner is designed to help you track your total monthly income and expenses.

Another section of this planner is allocated for writing notes and your monthly savings.

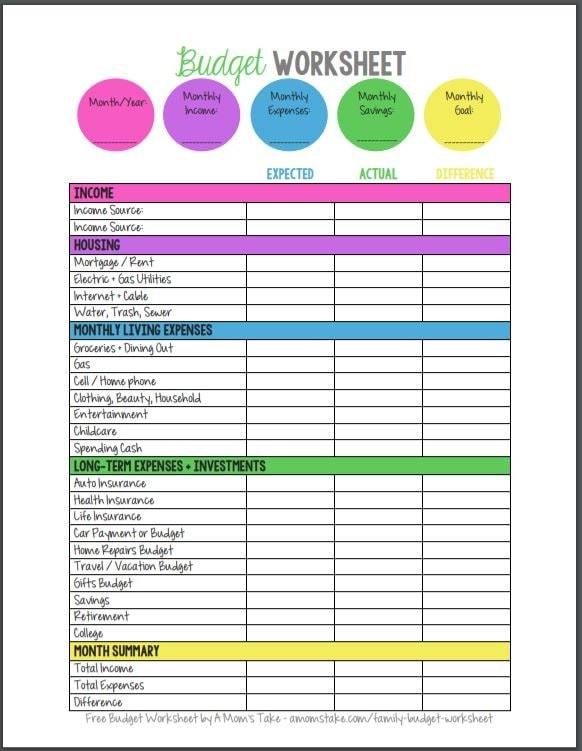

4. Budget Worksheet

via A Mom's Take

This budget worksheet includes a list of typical items that need budgeting in a household. These are grouped into main categories, such as

There is also a column for checking the actual amount of deficit or savings a family has at the end of the month. This feature is quite helpful for preventing uncontrolled spending.

5. Budget at a Glance

This budget sheet printable provides an overview of your family budget.

The upper portion of the page provides space to indicate the source(s) of income, the date they are paid, and the amount paid.

A column designated for comments is also provided. It is helpful for writing down important reminders related to the family budget.

Below the “source of income” section, a list of expenses is provided, with categories such as food, housing, and utilities.

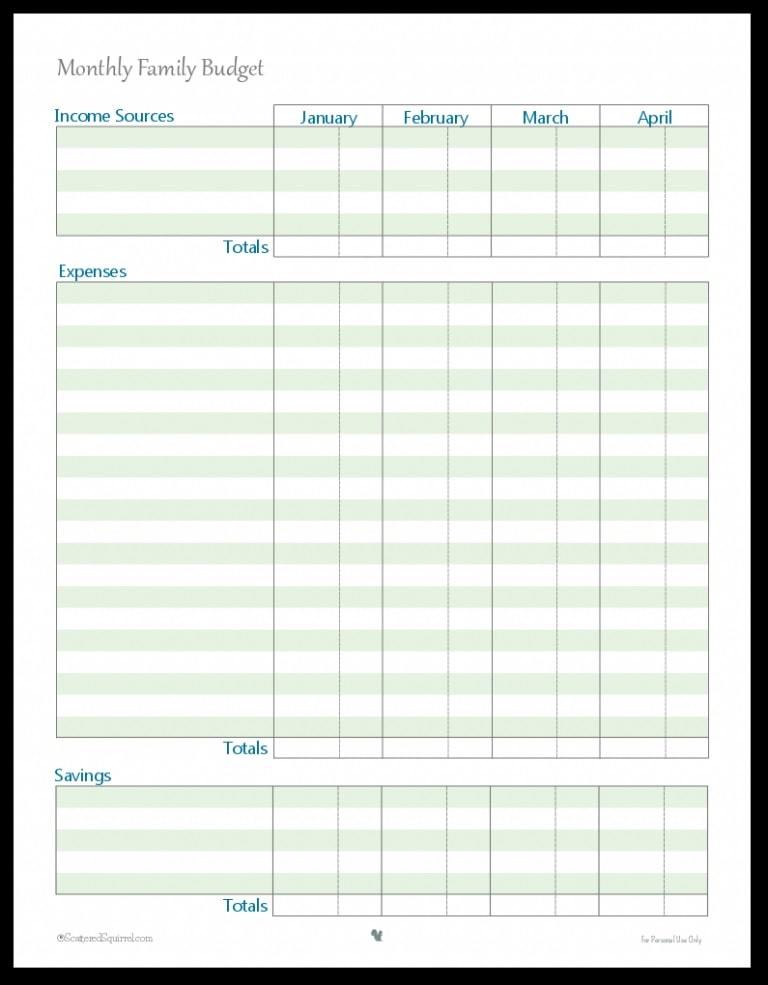

6. Monthly Family Budget

This template has sections for keeping track of your family’s spending habits within four months.

With this template, you can:

This template is ideal for seeing how a long-term financial goal is progressing.

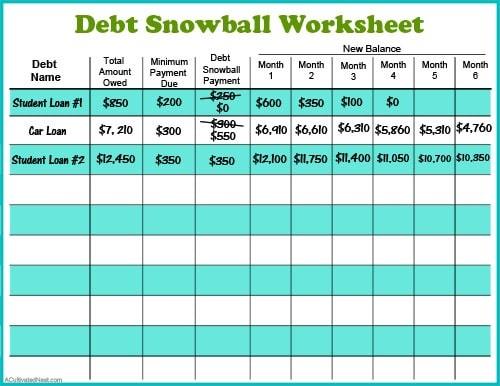

7. Debt Snowball Worksheet

If you’re looking for a system that can help keep track of your household’s debt so that you can pay it off more quickly, you might be interested in the debt snowball method. (Check out this post for a review of the debt snowball and debt avalanche systems.)

This printable tracker can help you monitor the progress of your debt repayment.

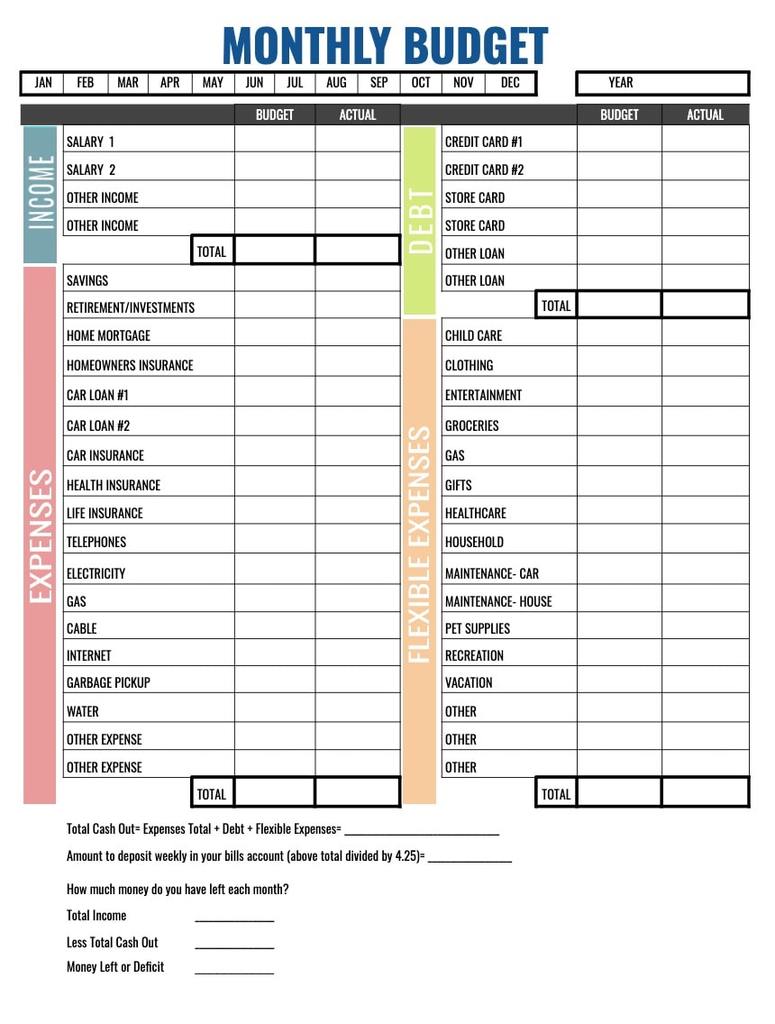

8. Tabular Monthly Budget Template

via Coupons (and Recipes) for Your Family

In this budget template example, each item on the household’s monthly expense list is categorized as a regular expense, flexible expense, or debt.

Households that utilize a budget system to manage their finances report positive results.

For example, budgeting has helped families understand what they can and cannot afford every month. This paves the way for many families to save and buy things they truly want.

9. Monthly Budget Sheet

This well-designed budget sheet will keep your budgeting on track. It provides ready access to information, whether you’re within budget or already in a deficit for the month.

If you’d like, you can use the pre-filled sheet, which features a categorized list of expenses that most families have.

Some of the categories include:

There are also areas for creating a savings plan, specifying your family’s monthly income, and indicating a starting balance for savings and debt.

Not keen on the pre-filled template? The sheet also comes in a blank format, making it easier to customize according to your family’s monthly spending.

10. Minimalist Monthly Budget Template

This template has a simple, clean design, ideal for those who want a minimalist aesthetic.

It allows you to keep track of income, savings, fixed expenses, and variable expenses. Furthermore, it summarizes your funds for the whole month for quick reference.

11. The Budget Tracker

This following example is a pretty straightforward budget worksheet that will help you keep track of all your monthly household expenses in one place.

This template is also very versatile and can be used to track different types of budgets.

12. Template for the Monthly Budget

This template has areas for writing down the amount allocated for a specific expense, the actual amount spent, and the difference between the two, which gives you a quick overview. Hence, you know if you’ve overshot or are still within budget.

A “Notes” column lets you enter important, relevant information about each specific expense on the list.

Knowing how much money your family has spent each month can encourage the members of the household to be more conscious about spending.

Maybe some money you save this month can go into the family savings?

13. Zero Based Budget

The zero based budgeting system encourages you to justify all household expenses every month.

This differs from traditional budgeting, where a company or household simply builds upon a previous budget and deducts from or adds to the amount allocated for each item.

Budgeters using the traditional method need to justify new expenses only when they arise, which can result in unnecessary spending.

This template is designed to work with the zero-based budget system. It allows you to plan your household’s spending every month from the ground up.

14. Household Budget Template

If you’re new to budgeting, you might want a no-frills budget template.

This printable is perfect for this.

There are spaces for writing the following information for your monthly budgeting:

This template also features a very apt quote from Albert Einstein:

“Learn from yesterday, live for today, hope for tomorrow.”

15. Budget Planner With Mini Bills Tracker

This budget tracker has provisions for tracking family expenses, such as:

Once you’ve decided on a budget allocation for every item, you commit to keeping your spending within the allocated amount.

Another advantage of a budget planner is that it helps prevent impulse spending. With a tracker, you are always conscious of where your money goes.

Furthermore, it challenges you to do better by spending less than you did the previous month.

16. Family Budget Template

You might like this blue-themed budget worksheet if you love the color blue.

It helps you keep track of your household’s monthly budget and features a bar progress chart that depicts the status of a specific financial goal.

This encourages frugal living and exercising mindfulness when it comes to spending, rather than being obsessed with constantly purchasing the latest gadgets, appliances, fashion, etc., like the rest of society.

17. Monthly Budget Tracker

Keep track of your monthly spending and savings with this pink-themed budget template.

This tracker promotes awareness about your household’s spending habits by letting you write a goal amount and compare it with the actual monthly expenses.

The same goes for savings and debt. There are columns for writing the goal amount and the actual amount spent.

Expenditures are broken down into different categories, such as:

Each category lists items with corresponding spaces for writing a goal amount/budget and the actual amount spent for each item.

18. Simple Budget Tracker

This template has a section for listing all the income you expect to receive for the month.

The section has columns labeled “Date,” “Description,” and “Amount.” It also has a column labeled “Paid,” which features boxes in which you can put a check mark when you’ve received the expected income.

In addition, this tracker features an expense tracker where you can write down the date of purchase or payment of an item or service, the expense (name of item or service), and the amount paid.

Similar to the “Income” section, you can also tick boxes for when the purchase or payment has been made.

This template also has a designated column for making a running list of your monthly daily expenditures.

Finally, at the bottom of the page is a section for writing down the estimated and actual amounts for your income, expenses, and remaining total.

This way, you’ll know at a glance if you could save some money for the month.

19. Monthly College Budget

Are you a college student who needs a tool to help manage your funds? Here’s a template that can help.

The template’s layout is designed to improve your financial literacy. It has sections dedicated to recording your monthly income and expenses.

There are pre-set categories for organizing the expenses you’ve incurred during the month. There are also columns where you write the estimated amount you plan to spend for a specific category and the actual cost.

This system provides a simple yet effective way of tracking where your funds go. In the long term, it teaches you to save money by motivating you to spend below your budget.

20. Monthly Family Budget Worksheet

This worksheet is designed to help keep track of the monthly family budget.

It has sections allocated for recording the following items:

The worksheet also has a section for writing the family’s financial goals for next month.

21. Budget for the Month at a Glance

Using a budget worksheet gives you an advantage when it comes to controlling your finances. This template shows you the status of your finances at a glance.

One section features an itemized and pre-set budget for all your monthly expenses. All you need to do is write down the amount for every item.

The template also has a dedicated section for listing down income and a monthly total box to give you an idea of your overall balance for the month.

This process helps determine whether your income is enough to cover all your expenses or if you need to change your spending habits.

22. Budget Worksheet for Beginners

Are you new to budgeting? Here’s a worksheet that can help you feel more in control of your monthly expenses.

A relatively straightforward budget template, it features sections for the following budgeting elements:

23. Budgeting Template Pack

This budgeting template helps you do more than track your monthly spending. It has 15 pages featuring:

Final Thoughts About Budget Printables

There you have it –23 examples of budget worksheet printables that you can use to keep track of your household’s expenses.

We hope that you found a favorite design among the ones featured today and that this article encouraged you to cultivate a better money habit.

Not only will doing so increase your family’s wealth, but it will also teach your children how to be responsible and mindful of spending any money that comes their way.

Check out our roundup of other expense trackers if you want more examples.

Finally, you might want to check out the following posts for more resources about developing better money habits:

Finally, if you want to take your goal-setting efforts to the next level, check out this FREE printable worksheet and a step-by-step process that will help you set effective SMART goals.