Let me ask you a personal question:

How is your financial situation?

If you’re like the 50% of Americans in this 2017 report, then you might be living paycheck to paycheck.

Even though the economy has seen significant improvement and people are earning more, there are still those who can barely make ends meet every month. This is something that makes you stop and think.

The biggest cause of this disparity is the fact that most people are neck-deep in debt.

Whether it’s because they want their lifestyle to reflect their earnings or they are afraid of missing the latest trends in fashion and technology, many Americans spend more than they can afford.

Having financial problems can take a toll on a person’s health and damage relationships.

But there are ways to correct the issue. In this article, we’ll talk about how to stop spending money on unnecessary things in order to achieve true happiness and freedom.

First, let’s discuss the reasons for our overspending.

7 Reasons Why We Overspend

1. We overspend because it is now too easy to swipe a card or click the “buy” button.

To be honest, plastic just doesn't feel the same as holding onto paper cash.

It is easy to use credit and overspend more than you would if you had cash because you may not even look to see how high your credit card balance is, or how small your checking account balance is.

When you count out your dollar bills when you're buying something, you're aware of the amount of money that you are giving up. Researchers have even named this behavior “the pain of payment.”

But this doesn't happen when you pay with a card or buy something online. You don't have to look at the total before signing for the purchase, which is why this can easily lead to overspending.

2. We believe that it’s socially acceptable to incur debts.

If you have a balance on your credit card every month, or are swimming in endless student loan debt, adding some more debt may not feel like a big deal.

It may even seem to be the “norm” among the people you know. Incurring debt may even feel like a valuable investment.

In fact, one study found that among people between the ages of 18 and 27, credit card and other loan debt was directly correlated with a higher level of self-esteem and a feeling of more control over one’s life.

However, this feeling fades with age, likely as people start realizing how long it will take to pay off the debt that they have incurred.

3. We do not track our expenses, nor have a budget.

A recent survey found that only 41% of Americans use a budget and actually track their expenses against that budget each month.

This suggests that most people have no idea how much money they should be spending every month in different areas of their lives, such as food, living expenses, car payments, entertainment, and clothing.

Without having a budget for these expenses, it is easy to go overboard without realizing it.

If you track your expenses and know exactly how much money you can allocate to each part of your life every month, you will be more likely to spend within your means. (Check out this collection of free budget printables and this collection of free expense trackers.)

4. We use retail therapy as a way to numb or momentarily escape pain.

A recent study found that over half of Americans admit to turning to “retail therapy” during times of stress. Additionally, 62% of shoppers have made purchases to cheer themselves up, and 28% have made purchases to celebrate something.

When people think of retail therapy, escape, entertainment, and excitement usually come to mind. Online shopping is increasingly noted as being a type of “mini mental vacation.”

Shopping is a pretty mindless, relaxing activity—especially if you're not buying anything. However, sometimes, when you come across just the right thing, you feel like you have to buy it.

5. We have no clear idea how much our net income is (after paying our bills, taxes, and other deductibles every month).

Sure, you know what your salary is, but have you ever broken that down into your expenses? Even if you believe your salary is relatively high, bills and expenses add up quickly, and the numbers may be shocking once you add them up.

Don't just think about your mortgage and cell phone bill—take into account your car insurance, personal property taxes, and the money you spend on the weekends for entertainment.

Create a spreadsheet that has your income and expenses on it to see how much money you have left at the end of the month. Chances are, it isn't quite as high as you may think.

6. We are in denial about our own spending habits.

If you refuse to track your spending or create a budget, or you convince yourself that you can't afford to save money, you're probably in denial about your overspending.

Overspending doesn’t just mean that you are spending too much money on things that you don’t need, it also means that you could be spending too much money on things that you try to convince yourself that you need.

When you're not in denial, you are able to limit your purchases to just the things that you need, not the things that you want in the moment—which is a good sign that you have control over your finances.

7. Ads compel us to buy stuff we don’t need. We have a fear of missing out, and overspend to keep up with the rest of society.

Everyone wants to keep up with the people around them, and acquire all of the new material items that are popping up. Social media has added to this problem for two reasons.

First, you see people that you know in pictures wearing the coolest new clothes or having the hottest new bags.

Second, companies are able to advertise on social media—especially the more expensive items that are probably outside of your budget. In fact, your browsing activity can help companies send you very targeted adds to try to pique your interest.

That fear of missing out is haunting, and it can often get the best of people when it comes to buying material things.

But research shows that 39% of people have spent money they didn’t have in order to keep up with their friends, and 36% of people don't think that they can keep up with their friends for one more year without going into debt.

So while there are a lot of reasons that people overspend, there are also several reasons why you should focus on saving money.

Hopefully, you will find these reasons to be compelling, and realize that the things that cause people to overspend are not worth it in the long run.

Why You Should Focus on Saving Money

It makes you feel more in control of your life.

When you are secure in the knowledge that you have some money saved, you can feel that you have a better grip on things.

You don't have to feel like you always have to depend on other people to help you get out of a bind because you have the money put aside for emergencies when you need it.

You also know your spending limits. If you stick to them, you will be able to control exactly where your money goes, and live in line with your priorities and values by spending more money in certain areas and less money in others.

It improves your health.

Knowing that you have some funds set aside helps you feel less stressed about making ends meet. And the truth is, a lot of people cite finances as being their biggest source of stress. This peace of mind helps reduce your risk of hypertension and other diseases.

As a result of financial stress, people often lose sleep, have anxiety, obsess over past financial decisions, and even fight with their spouses.

What's more, money stress can feel like it will last forever when you’re in the thick of it, which may make it feel even worse.

It helps your weight loss goals.

There is a positive correlation between saving money and losing weight. Most people spend their income by eating out, and eating fast-food fare is the main reason for the rise of obesity in the United States.

Eliminating this unhealthy eating habit not only helps you save money, but also allows you to have healthier meal options and the opportunity to slim down.

In fact, some of the healthiest foods in the world are actually the least expensive. Buying produce that is in season, along with whole grains and beans, will provide your body with all of the nutrition that it needs to stay healthy.

If you stop spending money on restaurant food, you will save more money than you could imagine, and you will start to drop weight quickly.

It is good for the environment.

If you are conscious about your use of electricity and water, then you reduce the amount on your monthly utility bills. By deciding to live more thriftily, you can maximize the 3 R’s: reducing, reusing, and recycling.

Even if you are spending a little bit more money up front for an eco-friendly car, you will be saving money in the long run on gas, while also helping to save the environment. The same goes with upgrades to your home, such as insulated windows or efficient appliances.

While these things cost a bit more in the beginning, they will greatly reduce your monthly bills and therefore pay for themselves in no time. Also, they help save electricity and keep the environment clean.

It helps you become more independent financially.

Being financially independent means having the freedom to make choices that are not dependent on your monthly paycheck. Everyone defines “wealth” differently, but one thing that most people agree on is that wealth equates to financial independence and a savings account to depend on.

This means that you have the freedom to make decisions in your life independently from earning your paycheck.

This may mean that you can help out family members financially, take vacations every year, or choose personal satisfaction over salary when considering what type of job you want.

Financial independence doesn't necessarily mean that you're rich—it simply means that you don't have to depend on your paycheck or other people if something comes up.

You have something to use in case of emergencies.

Unforeseen circumstances could include being injured and unable to work, needing a major auto or home repair, losing a job, or having to fly out to another state for a close relative’s funeral.

These examples all require you to spend money, and having set aside some in savings can help prevent you from going into debt.

When these unexpected things occur, you will be relieved to be able to turn to your savings account rather than having to take out a loan or incur debt. It is best to have about six months' worth of savings set aside to pay all of your living expenses in case you lose your job.

In this eight-minute video, Matt D’Avella talks about money and the overspending issues we face, gives reasons why we might not manage money properly, and provides tips on how to manage personal finance through a minimalist approach.

11 Tips on How to Stop Spending Money

1. Understand what psychological triggers compel you to spend.

In many cases, figuring out how to stop spending money relates to identifying the emotional and psychological triggers that lead to your spending.

By removing your habit triggers, you will no longer have the opportunity or the temptation to spend money that you don't have.

It could be that you’re unhappy (emotional), with shopaholics (peer pressure), in a Christmas crafts fair or your favorite dollar store (environment), or trying to keep up with a luxurious way of life (lifestyle).

When you know these triggers are going to be present, make sure to just carry a little bit of cash with you instead of hanging on to your credit card. This will help limit your spending.

The important thing is that you surround yourself with people and environments that will not tempt you to go overboard with your spending.

2. Stop using your credit cards.

Credit card use is one of the main reasons people overspend. Since it’s more convenient to swipe a card, most people use this mode of payment. Use cash for your next purchases to curb the urge to spend more than you can afford.

When you pay for things with cash, you see how much money you have and how much you're giving away. Paying in cash forces you to only spend what you have.

Cut up any credit cards that are specific to one store, and try to only keep one main credit card open, if any. Make sure you pay off the entire balance each month so you don't incur interest.

3. Spend only the money actually available to you.

The cash envelope system is a good way to stick to your budget and use only the money that is actually available to you.

Based on your budget, put the amount of cash that you can spend in every category (such as food, clothing, and entertainment) into an envelope every month. Once the cash is gone, it's gone for the month. This will force you to budget properly and not overspend.

By paying with cash, you will not rely on credit, and you won't spend money that you don’t have. The cash envelope trick will encourage you to get creative and resourceful with your spending.

If you overspend one month and don’t have any money left to go to the movies with your friends, you will have to come up with new ways to save money, or think of less expensive ways to hang out with your friends.

4. If you think you need to buy an item, ask yourself a couple of questions:

a. What value will it add to my life? If the item brings happiness or serves a purpose, then the purchase is worth it. But look at your motives.

Do you want to buy the item because it will truly add to your life, or are you trying to impress someone else? Before you purchase something, give it some serious consideration.

b. Do I need this item to get through the day? If you answered no, then the purchase can wait, and perhaps you’ll realize that you don’t need the item at all.

c. How often will I use this item? If this is something that you will probably use once and then leave in a closet to gather dust, pass on it. Also, is this item something that you could borrow from a friend if you only intend to use it a few times?

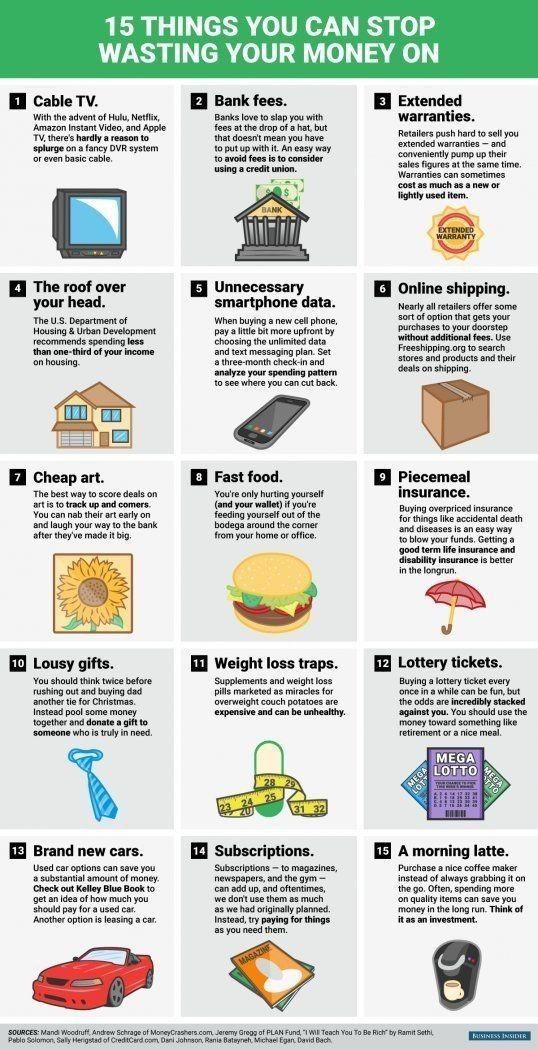

The infographic below shows examples of items you should not be spending your money on if you want to live a happier life.

5. “Shop” in your closet for clothes.

The average American throws away about 80 pounds of clothes every year. If you feel the urge to buy new clothes, try looking into your closet first for something that you may have only worn once.

You might be able to put together an outfit that you had never thought of, or put together some of your existing clothes to meet a current trend that you hadn't thought of before.

First, you need to get your closet organized and fix any clothes that have holes or are missing buttons. Then take out some jewelry cleaner and get all of the tarnish off of your old jewelry to make it look new again.

If you can get your basics looking great, you will have enough clothes to last you through the whole season.

6. Develop good money habits.

Becoming financially savvy is a way of increasing your savings and adding value to your life. Good money habits are all about small changes and critical adjustments in your mindset.

For example, you can create rules for yourself, such as waiting one month before buying something that you see to give yourself time to really consider it (or forget about it). Or, you can tell yourself that you have to get rid of two items that you own for every one item that you purchase.

It is also important to examine your frugal habits to make sure that they are indeed worth it. For example, if you are driving 10 minutes out of your way to save a few dollars on gas, it probably isn't worth your time or the extra mileage on your car.

The best thing you can do is to keep things simple and create a budget that you can stick to. Don't let your finances get too complicated by using multiple apps and creating several spreadsheets. This will increase your chances of giving up your good spending habits. Just keep it simple.

For more on these habits, take a few minutes to check out the video below:

7. Avoid eating out.

In addition to spending less money by cooking your own meals, not eating out also means you’re in control of how healthy your meals are. Yes, eating out is easy and it saves time. But if you're spending $8 on a fast-food lunch every day, that's $240 per month.

The key is to create a plan to avoid eating out. Start by meal planning and prepping food on Sundays to last you through the week.

A lot of people don't feel like cooking when they get home from work, so avoid that by doing it all ahead of time. And you don't even have to make everything from scratch. Using frozen vegetables is both cheap and healthy.

8. Embrace minimalism.

Minimalism is intentionally living with just the things you really need. It allows you to see and appreciate the value of what you have in life. It also discourages you from buying more stuff.

Minimalism is becoming increasingly popular for several reasons. Not only does it save money because it forces you to differentiate between essential items and non-essential items, but it also is environmentally friendly because it reduces waste.

Minimalism also offers a life with a reduced amount of stress, fewer distractions, and an increased amount of freedom

Finally, while consumerism is alive and well, there is a growing number of people who are starting to see through the fiction of the claim that every new product will actually make your life more fulfilling. While people often try to find happiness in new possessions, they are typically left unfulfilled.

In this 15-minute TEDx video, Ryan Nicodemus and Joshua Fields Millburn, known to their readers as The Minimalists, share their thoughts on what makes people truly rich, the definition of minimalism, and finding happiness and value in their lives.

9. Be aware of financial pitfalls as you become successful.

When you begin to earn a significant amount of money, it is tempting to buy stuff that reflects your current lifestyle. Learn to avoid lifestyle creep to keep your spending at bay.

If you start making more money or your bills decrease, boost your savings rather than making your lifestyle more lavish.

Don't make former luxuries into your new everyday rituals—those things will no longer be special, and you will be back in the financial situation that you were in before your net income increased.

10. Get stuff for free.

If you need some items, why not try getting them secondhand through an online community whose members give stuff away for free in their areas, such as Freecycle?

You can also ask around to friends and family if you need something specific. Whether you want to borrow it or keep it, most people are holding onto all kinds of things that they have no use for anymore.

11. Use your free time for hobbies.

When you are busy doing things you love, not only will you keep life interesting, but you’ll also have less time for shopping.

Spending your time doing hobbies is fulfilling and can be as inexpensive as you want it to be. Find your passion and put your time and energy into cultivating your talents or knowledge in that area.

Find a friend who shares your hobby and team up to do it together. Adding the element of a human connection to any activity you are doing makes it all the more fulfilling.

Final Thoughts on How to Stop Spending Money

Today we’ve learned that most Americans have difficulty managing their finances, despite the fact that they’re earning more in recent years.

We’ve also discussed the solutions to financial issues, with the primary action being making a change in your spending habits.

We hope that the suggestions listed here on how to stop spending money on unnecessary stuff will lead you to a life full of true and lasting happiness and financial freedom.

If you are interested to learn more about positive financial habits, head over the following posts for helpful tips on how to achieve financial stability and success.

I’m doing this thing where I’ve saving a dollar a day.

We have dollar coins where I’m from.

So what I’ll do is save a dollar coin every day, or more if I feel like putting in more on a given day.

But the requirement is to save it at least 1 dollar coin every day.

And I’ve learnt ALOT from the process doing this!